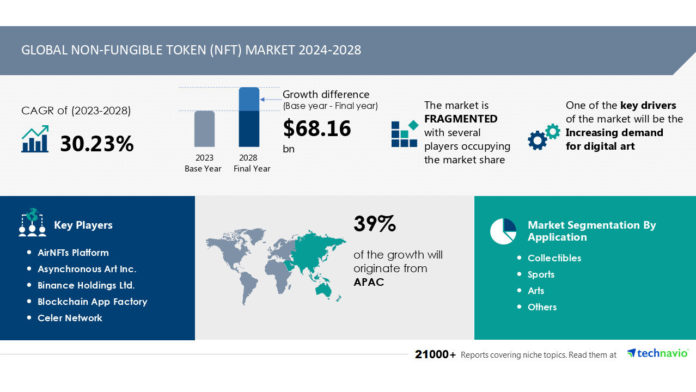

The global non-fungible token (NFT) market size is estimated to grow by USD 68.16 billion from 2024-2028, according to Technavio. The market is estimated to grow at a CAGR of 30.23% during the forecast period. Increasing demand for digital art is driving market growth, with a trend towards growing interest in nfts among major brands. However, uncertainty in nfts poses a challenge. Key market players include AirNFTs Platform, Asynchronous Art Inc., Binance Holdings Ltd., Blockchain App Factory, Celer Network, Chaincella, Decentraland Foundation, Enjin Pte. Ltd., Foundation Labs Inc., Funko Inc., Gemini Trust Co. LLC, Mintable.app, Ozone Networks Inc., Out The Mud Ventures Inc., Rarible Inc., Sky Mavis, SuperRare Labs Inc., Tiki Labs Inc., Yellowheart LLC, Axie Infinity.Cloudflare, Inc.; PLBY Group, Inc.; Dolphin Entertainment, Inc.; Takung Art Co., Ltd.; Dapper Labs, Inc.; Onchain Labs, Inc

NFTs, or Non-Fungible Tokens, have taken the art, athletes, and celebrities worlds by storm. These digital assets, representing unique items like artworks, collectibles, and even virtual real estate, are creating buzz in various industries. Blockchain technology powers NFTs, ensuring transparency, ownership, and scarcity. The gaming industry and media & entertainment sector are leveraging NFTs for tokenizing games, trading cards, and virtual items. Artists and athletes are minting NFTs of their digital artworks and collectibles, offering fans exclusive ownership. Augmented Reality (AR) and Extended Reality (XR) are enhancing the NFT experience, making it more interactive. The NFT community is growing, with online platforms enabling easy buying, selling, and trading. However, regulatory considerations, consumer protection, and legal frameworks are crucial. Fraud and taxation are concerns, with securities laws and intellectual property rights coming into play. Blockchain networks like Ethereum and proof-of-work/stake mechanisms ensure secure transactions. The NFT market is evolving, with potential applications in decentralized finance, music, and even virtual vehicles. The future looks promising, with the metaverse and virtual reality (VR) offering new possibilities. The White House and third parties are exploring NFTs, signaling mainstream adoption.

Big brands, such as Visa Inc. And Budweiser, are increasingly exploring the Non-Fungible Token (NFT) market for potential earnings. In August 2021, Visa Inc. Made a significant investment by purchasing a CryptoPunk NFT for approximately USD165,000. This acquisition expanded Visa’s historic commerce artifacts collection. The primary motivation for these corporations is the opportunity to generate additional revenue. Furthermore, they are focusing on utilizing NFTs as incentives for consumers. For instance, NFTs can serve as innovative rewards, offering exclusive gifts to loyal customers.

Non-Fungible Tokens (NFTs) have disrupted the art, collectibles, and entertainment industries by allowing unique digital assets to be bought and sold as property. Artists, athletes, celebrities, and even the White House have joined the NFT community, creating digital artworks, collectibles, and virtual items backed by blockchain technology. NFTs provide proof of ownership, scarcity, and authenticity, making them attractive to investors. However, challenges persist, such as regulatory considerations under securities laws, consumer protection, and fraud. Distributed networks like Ethereum facilitate NFT trading, but logistical issues and taxation remain unclear. The gaming industry, media & entertainment, and decentralized finance are exploring NFTs for tokenization of games, virtual items, and digital property. Augmented Reality (AR) and Extended Reality (XR) are expected to enhance the NFT experience. However, legal frameworks and regulatory considerations need to address intellectual property, third-party rights, and securities laws. Ultimately, NFTs offer a new way to monetize and trade digital assets, but careful planning and regulation are crucial to ensure a fair and secure marketplace.

The Non-Fungible Token (NFT) market presents both opportunities and challenges for sellers. Valuation of NFTs is uncertain due to the difficulty in determining future demand and pricing. Factors such as scarcity, uniqueness, and buyer perception play a significant role in determining NFT value. New sellers face challenges in anticipating buyer identity and purchase drivers. As the market continues to evolve, predicting future trends in NFT pricing remains difficult for new investors. The value of NFTs is subjective and dependent on buyer perception, leading to price fluctuations.

Non-Fungible Tokens (NFTs) refer to unique digital collectibles, minted on the Blockchain. These collectibles are limited-edition and cannot be exchanged or replicated. Vendors offer online platforms for buying and selling NFTs. Key features include the owner’s exclusive right to sell, royalty payments on future sales, and protection against unauthorized use or copying. The NFT market’s expansion is fueled by the increasing demand for digital assets worldwide. Industries are going digital, and the Internet’s ubiquity, along with rising usage, encourages investments in digital assets. Tokenization, which creates digital tokens representing asset ownership, further boosts market growth. These factors are expected to significantly contribute to the growth of the global NFT market.

The Non-Fungible Token (NFT) market is revolutionizing the way we buy, sell, and own digital assets. This innovative technology allows for the unique representation and ownership of electronic artworks, gaming items, and collectibles on the blockchain. The gaming industry has embraced NFTs, enabling tokenization of in-game items and creating new revenue streams. NFTs on Ethereum network provide scarcity and ownership, making digital artworks valuable and collectible. Legal frameworks are evolving to accommodate this new asset class, while AR, VR, and XR technologies enhance the NFT experience. Blockchain technology and cryptocurrencies power the NFT market, with Web 3 enabling decentralized finance and creating new distribution networks. Fraud prevention is crucial in this market, with NFT suppliers ensuring authenticity and ownership. The NFT market offers a new frontier for creators, collectors, and investors, with Magic Eden and other platforms serving as marketplaces for these unique digital assets.

The Non-Fungible Token (NFT) market is a revolutionary digital ecosystem where Art, Digital Artworks, and Collectibles come to life as unique, verifiable, and tradable assets on the blockchain. This decentralized platform allows Artists, Athletes, and Celebrities to monetize and showcase their Intellectual Property in the form of NFTs, including Painting, Music, and even Virtual Real Estate. Blockchain technology enables Ownership and Transfer of these Digital Assets with transparency and Security. NFTs are not limited to the Art World but extend to Gaming Industry, Sports Collectibles, Trading Cards, and Virtual Items. The market also includes Decentralized Finance, Cryptocurrencies, and Cryptocurrencies/assets. Regulatory considerations and Consumer Protection are essential aspects of this emerging market, with legal frameworks and Taxation being crucial. NFTs can be traded on various Online Platforms, and the market is expanding into Extended Reality (XR) and Metaverse, offering new opportunities for creators and investors. However, Fraud and Scam risks exist, highlighting the need for careful consideration and due diligence. NFTs represent a new frontier in the Digital Economy, with potential applications in various industries, including Media & Entertainment, Logistics, and even House and Vehicle ownership. Smart Contracts and Proof of Work or Stake are essential components of the NFT market, enabling seamless Transactions and Distribution Networks. The NFT community continues to grow, with various Third Parties offering services and solutions to facilitate the creation, trading, and management of NFTs. The NFT market is a dynamic and evolving space, offering endless possibilities for creators, investors, and consumers alike.