Revenues from digital music services match those from physical format sales for the first time, according to IFPI’s Digital Music Report, published today.

Digital revenues rose 6.9 per cent to US$6.9 billion, representing 46 per cent of all global music sales and underlining the deep transformation of the global music industry over recent years. The industry’s overall global revenues in 2014 were largely unchanged, falling just 0.4 per cent to US$14.97 billion (US$15.03 billion).

The new report shows an industry in continuing transition, with consumers embracing the music access models of streaming and subscription. Another steep increase in subscription revenues (+39.0%) offset declining download sales (-8.0%) to drive overall digital revenues, while the number of paying users of subscription services rose 46.4 per cent to an estimated 41 million.

Subscription services are now at the heart of the music industry’s portfolio of businesses, representing 23 per cent of the digital market and generating US$1.6 billion in trade revenues. The industry sees substantial further growth potential in the subscription sector, with new services advancing in 2015 led by three major global players: YouTube’s Music Key, Jay Z’s TIDAL and Apple’s expected subscription service.

Frances Moore, chief executive of IFPI, says: “The recorded music business has always led the way for creative industries in the digital world. That leadership continues today as the music industry’s digital revolution continues through new phases, driven by the consumer’s desire for access to, rather than ownership of, music. It is a reflection of how much we have adapted that digital revenues today are, for the first time, on a par with physical.

“The headline statistics of 2014 speak for themselves, with overall revenues still largely flat, down by 0.4 per cent. Music companies are charting a path to sustainable year-on-year growth. That path was never going to be straight, but we are making great strides along it, embracing new models, licensing, investing and improving consumer choice.”

The global recording industry is a portfolio business of different consumer channels and business models. This is underlined by the enduring nature of the physical format, still 46 per cent of the market, and the still substantial share of digital revenues (52%) accounted for by downloads. Physical sales still dominate in a number of key worldwide markets including France (57%), Germany (70%) and Japan (78%).

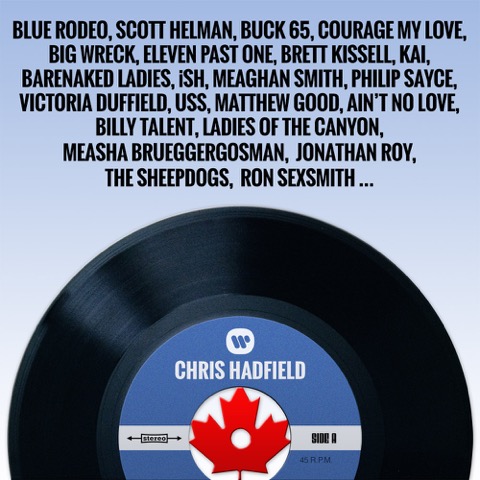

Within the physical business, vinyl sales continue to revive with revenues increasing 54.7 per cent and now accounting for 2 per cent of global revenues. This underlines the industry’s commitment to consumer choice and to delivering music to fans in the widest possible range of formats.

Elsewhere in the industry, performance rights income increased by 8.3 per cent and now accounts for 6 per cent of total industry revenues or US$948 million. Synchronisation revenues increased by 8.4 per cent in 2014 to represent 2 per cent of the market, with big gains in markets such as France (+46.6%), Germany (+30.4%) and Japan (+33.5%).

Note: In the reporting of IFPI’s 2014 global market data, there has been a reclassification of SoundExchange revenues in the US from “performance rights” to “digital”. This has resulted in an upward adjustment in digital revenues and growth, and an equivalent downward adjustment in performance rights revenues and growth.

KEY TRENDS IN DIGITAL MUSIC

Consumers engage with licensed services. Exclusive IFPI-commissioned research demonstrates consumer engagement with licensed digital music services is high. The study, undertaken by Ipsos across 13 of the world’s leading music markets in 2015, shows 69 per cent of internet users accessed a licensed digital music service in the last six months. Significantly more people say that they use these types of services more than they did 12 months ago, compared to those who say that they use them less.

Awareness of licensed services, such as iTunes, Spotify and YouTube, is high and some 38 per cent of respondents agree strongly or agree a little that they are happy to access music online, rather than own a CD or digital file.

However, IFPI estimates (based on comScore/Nielsen data) that 20 per cent of internet users (down from 26 per cent in 2013) still regularly access unlicensed services such as P2P file-sharing networks, cyberlockers and aggregators.

The rise of streaming. The defining positive characteristic of international music markets in early 2015 is the continued surge in consumer uptake of streaming services. Much of this is driven by young consumers with little or no experience of owning music and, therefore, less geared to traditional ownership models.

Potential for growth. Within the streaming sector, there is substantial untapped potential for growth within the paid-for category. The Ipsos research shows that 35 per cent of consumers have accessed free music streaming services in the last six months, compared to 16 per cent using paid-for music subscription services. While consumer use of free and paid-for services varies markedly between countries, there are showcase markets, such as Sweden and South Korea, proving that consumers will pay in large numbers for premium music subscription.

Bundling partnerships. Leading telecoms companies are now offering bundled music services to their customers as standard. These partnerships combine the marketing muscle and billing infrastructure of the telcos with the catalogue and curation of digital music services. Such offerings are playing a significant role in opening up emerging markets.

New payment models. Digital services are increasingly tailoring their offerings to reach different segments of consumers. At one end of the spectrum, UK service MTV Trax offers users access to up 100 tracks for £1 (US$1.49) a week, while at the other Deezer Elite offers users a high quality audio experience for US$20 a month.

Artist royalties. The rise of streaming services has also prompted wider discussion around the issue of artists’ royalty payments in the digital environment. In order to better inform this discussion, IFPI conducted research in 2014 to obtain an accurate picture of how royalty payments have changed as the market has shifted from physical sales to digital channels. Industry data compiled by IFPI from the three major companies, covering local sales for locally signed artists in 18 major markets outside Japan and the US in the five year period to 2014 shows that while sales revenue fell 17 per cent, total artist payments – in the form of royalties and unrecouped advances – declined much less in real terms (down 6 per cent) and increased significantly as a share of sales revenue, by 13 per cent. Over the five year period, the data shows that total payments by record companies to local artists totalled more than US$1.5 billion across the 18 markets.

ADDRESSING THE VALUE GAP

The music industry has made the changes needed for it to continue leading the creative industries in the digital world. Yet further steps are needed to secure the industry’s long-term success. Above all, there is a “value gap” which arises from the application of current legislation and has created a very significant mismatch between the value that certain digital platforms extract from music, and the value that is returned to rights owners. This legislative issue is the primary reason, along with piracy, why, despite offering consumers better choice, access and value than ever before, the recorded music industry has not achieved sustainable year-on-year revenue growth.

An illustration of this can be seen in comparing the share of revenue derived by rights owners from services, such as Spotify and Deezer, and those derived from certain content platforms, like YouTube or Daily Motion. IFPI estimates music subscription services have 41 million paying global subscribers, plus more than 100 million active users in their “freemium” tiers. This sector generated revenues to record companies of more than US$1.6 billion in 2014. By contrast, YouTube alone claims more than one billion monthly unique users and is thought to be the world’s most popular access route to music. Yet total global revenues to record companies generated by certain content platforms including YouTube amounted to just US$641 million in 2014, less than half the total amount paid to the industry by subscription services such as Spotify and Deezer.

Frances Moore says: “The value gap is a fundamental flaw in our industry’s landscape which sees digital platforms such as Daily Motion and YouTube taking advantage of exemptions from copyright laws that simply should not apply to them. Laws that were designed to exempt passive hosting companies from liability in the early days of the internet – so-called “safe harbours” – should never be allowed to exempt active digital music services from having to fairly negotiate licences with rights holders. There should be clarification of the application of “safe harbours” to make it explicit that services that distribute and monetise music should not benefit from them.”

NEW GLOBAL RELEASE DAY IN JULY 2015

Another new development is the industry’s decision to synchronise all global singles and albums releases so that they go to market on the same day.

From 10th July 2015, Friday will become the new global release day meaning music fans in different countries will be able to buy and listen to new artist releases at exactly the same time. The move meets consumer demand for equitable access to new music worldwide and provides new marketing opportunities for record labels at the weekend.

GLOBAL CHARTS: FROZEN, PHARRELL AND TAYLOR COME OUT TOP

The soundtrack to the motion picture Frozen was ranked top of the IFPI global album chart, published by IFPI for the first time today. The album topped the charts worldwide, in countries from Argentina to Japan, and sold around four million copies in the US alone.

The Academy Award-nominated Happy, the lead single from Pharrell Williams’ album GIRL and which also featured on the Despicable Me 2soundtrack, was ranked in the top slot of the IFPI 2014 global digital singles chart.

Taylor Swift became the second recipient of the IFPI’s Global Recording Artist award in 2014. The chart aggregates sales and streams of artists’ catalogue across a range of formats from CD sales to YouTube video streams.

GLOBAL TOP 10 ALBUMS 2014

| RANK |

ARTIST |

ALBUM |

TOTAL SALES (M) |

| 1 |

Various Artists |

Frozen |

10.0 |

| 2 |

Taylor Swift |

1989 |

6.0 |

| 3 |

Ed Sheeran |

x |

4.4 |

| 4 |

Coldplay |

Ghost Stories |

3.7 |

| 5 |

Sam Smith |

In The Lonely Hour |

3.5 |

| 6 |

One Direction |

FOUR |

3.2 |

| 7 |

AC/DC |

Rock or Bust |

2.7 |

| 8 |

Various Artists |

Guardians of the Galaxy: Awesome Mix Vol. 1 |

2.5 |

| 9 |

Pink Floyd |

The Endless River |

2.5 |

| 10 |

Lorde |

Pure Heroine |

2.0 |

Source: IFPI. Physical and digital albums included. Streams excluded

GLOBAL TOP 10 DIGITAL SINGLES 2014

| RANK |

ARTIST |

ALBUM |

TOTAL SALES (M) |

| 1 |

Pharrell Williams |

Happy |

13.9 |

| 2 |

Katy Perry feat. Juicy J |

Dark Horse |

13.2 |

| 3 |

John Legend |

All of Me |

12.3 |

| 4 |

Meghan Trainor |

All About That Bass |

11.0 |

| 5 |

Idina Menzel |

Let It Go |

10.9 |

| 6 |

Pitbull feat. Ke$ha |

Timber |

9.6 |

| 7 |

Iggy Azalea feat. Charli XCX |

Fancy |

9.1 |

| 8 |

Ariana Grande feat. Iggy Azalea |

Problem |

9.0 |

| 9 |

MAGIC! |

Rude |

8.6 |

| 10 |

Enrique Iglesias feat. Sean Paul, Descemer Bruno, Gente De Zona |

Bailando |

8.0 |

Source: IFPI. Units include single-track downloads and track-equivalent streams

GLOBAL RECORDING ARTIST CHART 2014

| RANK |

ARTIST |

| 1 |

Taylor Swift |

| 2 |

One Direction |

| 3 |

Ed Sheeran |

| 4 |

Coldplay |

| 5 |

AC/DC |

| 6 |

Michael Jackson |

| 7 |

Pink Floyd |

| 8 |

Sam Smith |

| 9 |

Katy Perry |

| 10 |

Beyoncé |

The compilation of the IFPI top artist chart has been independently verified through certain agreed procedures by BDO LLP. BDO LLP has verified that IFPI has compiled the chart correctly in line with the outlined procedures. The certain agreed upon procedures carried out by BDO did not constitute an audit review. Soundtracks and albums comprising of songs from Various Artists have been excluded on instruction from IFPI.

FOR FURTHER INFORMATION CONTACT:

Adrian Strain or Alex Jacob

Email: Adrian.Strain@ifpi.org and Alex.Jacob@ifpi.org

Tel. +44 (0)20 7878 7939 / 7940

To order a hard copy of the Digital Music Report when available please email laura.childs-young@ifpi.org

Please note that IFPI’s full global market report for 2014, Recording Industry in Numbers, will be published on April 20th. To be added to the alert list when that becomes available to purchase please contact ritco@ifpi.org

EDITORS NOTES

- Global market revenues by format: 2013 & 2014 (US$ billions)

|

2013 SHARE |

2013 VALUE |

2014 SHARE |

2014 VALUE |

% VALUE CHANGE |

| Physical |

49% |

7.42 |

46% |

6.82 |

-8.1% |

| Digital |

43% |

6.41 |

46% |

6.85 |

+6.9% |

| Performance Rights |

6% |

0.88 |

6% |

0.95 |

+8.3% |

| Synchronisation |

2% |

0.32 |

2% |

0.35 |

+8.4% |

| TOTAL MARKET |

|

15.03 |

|

14.97 |

-0.4% |

- Revenues in regional markets ($US billions)

|

2013 |

2014 |

% CHANGE |

| Asia |

3.45 |

3.33 |

-3.6% |

| Europe |

5.37 |

5.36 |

-0.2% |

| Latin America |

0.49 |

0.53 |

+7.3% |

| North America |

5.19 |

5.24 |

-1.1% |

- Subscription streams revenues (US$ billions) and estimate of global number of paying subscribers (millions) 2010-2014

|

2010 |

2011 |

2012 |

2013 |

2014 |

13/14 % CHANGE |

| Subscription streams revenue |

0.32bn |

0.45bn |

0.73bn |

1.13bn |

1.57bn |

+39% |

| Number of paying subscribers |

8m |

13m |

20m |

28m |

41m |

+46.4% |